Our History and Milestones at a Glance

2008

Moneythink is founded in Chicago, IL under the name “The Financial Education Initiative”

2009

Established independent university-based chapters across the country

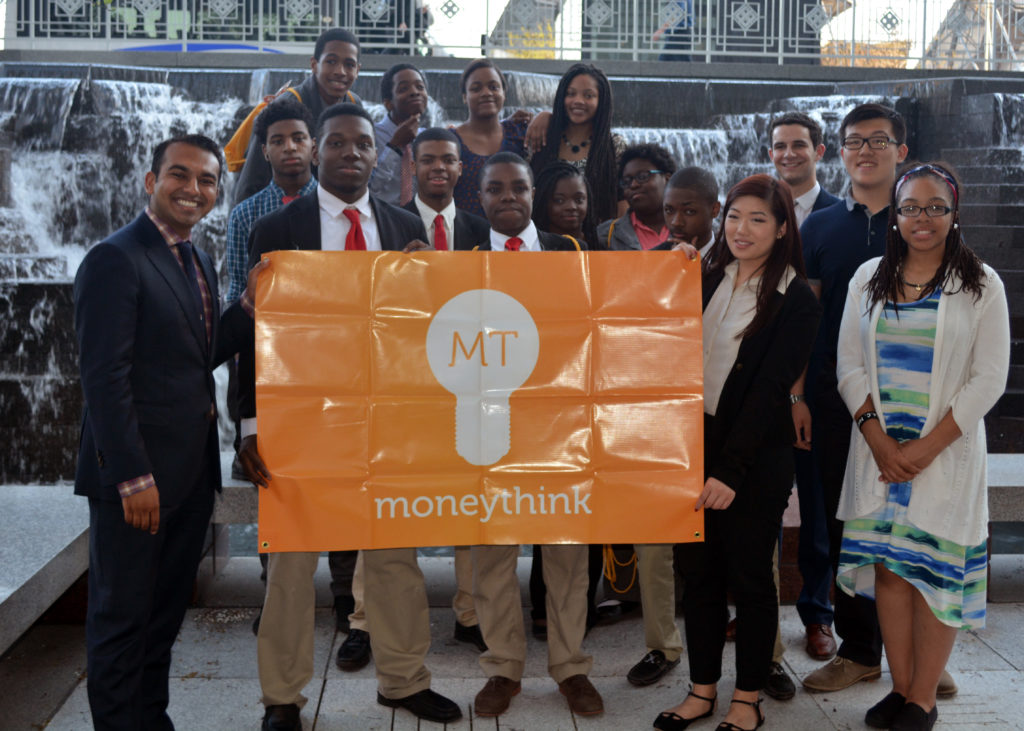

Changed our name to “Moneythink”

2010

Officially recognized as a 501(c3) nonprofit organization

2012

Received the White House Champions of Change and Chicago Innovation Awards

2013

Released our first fintech tool for students, MoneythinkMobile, in collaboration with Financial Health Network and IDEO.org

MassChallenge Winner

2016

San Francisco Bay Area, CA office established

Completed our research study of financial obstacles facing students

Launched our College Financial Success Virtual Coaching Program in Illinois and California

2018

Assisted thousands of students in accessing over $2.4 million in aid

Began working with college access partners in Texas

2019

Goldman Sachs Gives Challenge Fan Favorite Award

2020

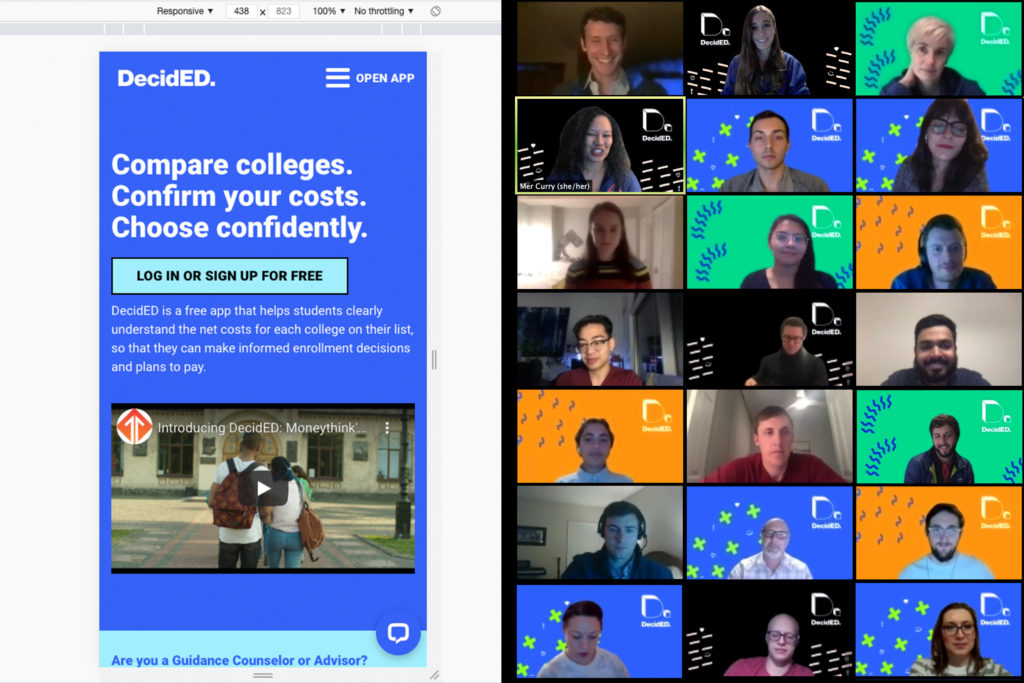

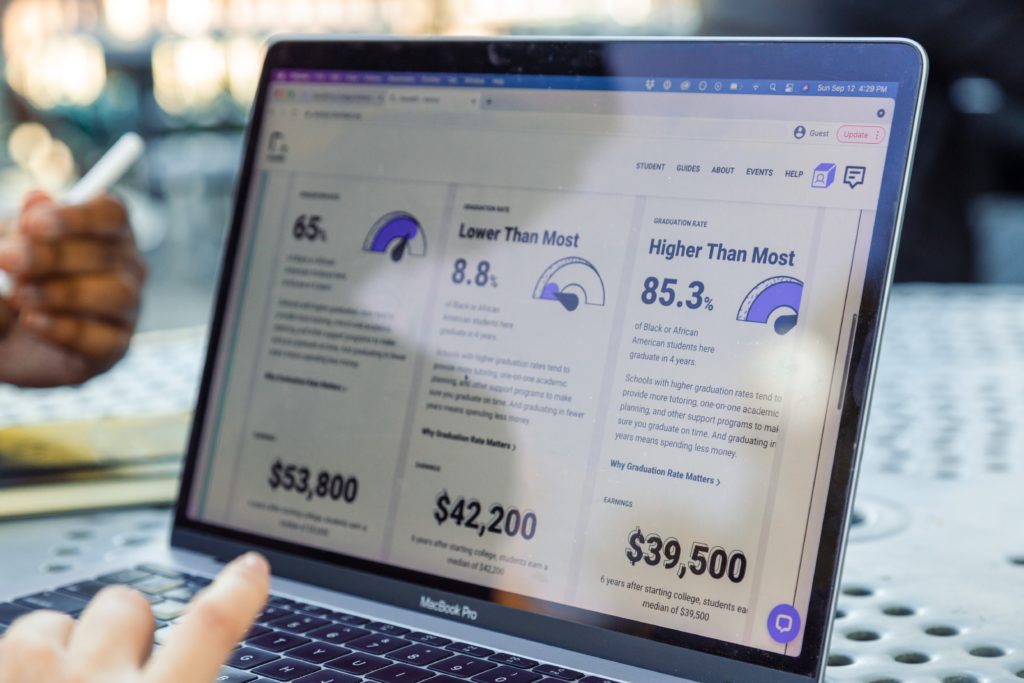

Launched DecidED, our free college affordability comparison tool

Selected by Capital One as their Nonprofit Partner of the Year

2021

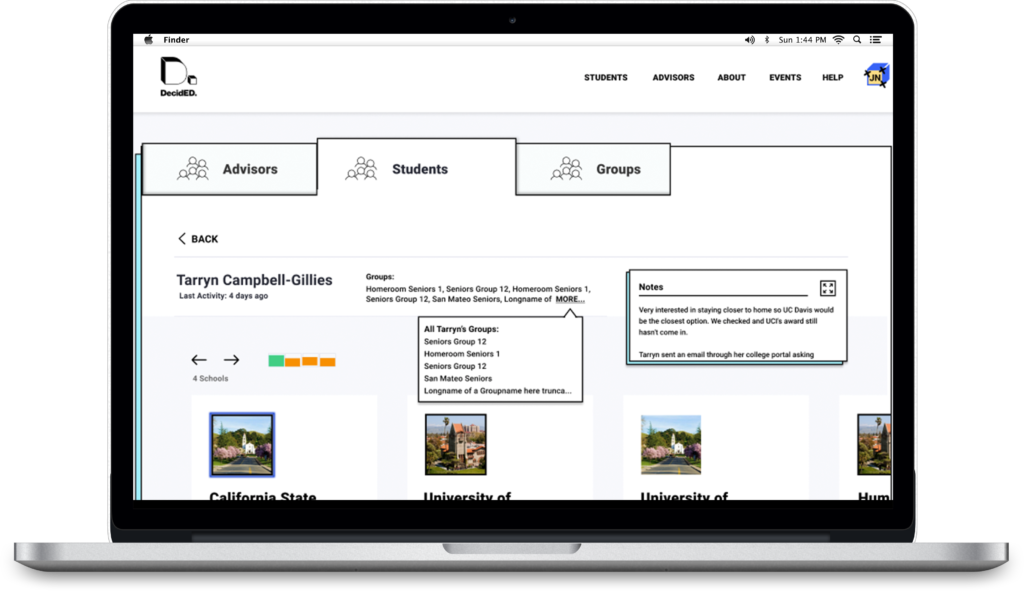

Released the DecidED Advisor Dashboard for college-access entities and schools

Added pilot partners across 8 states

Awarded a grant from the Bill & Melinda Gates Foundation to scale DecidED’s reach and impact

Our Path

The Beginning

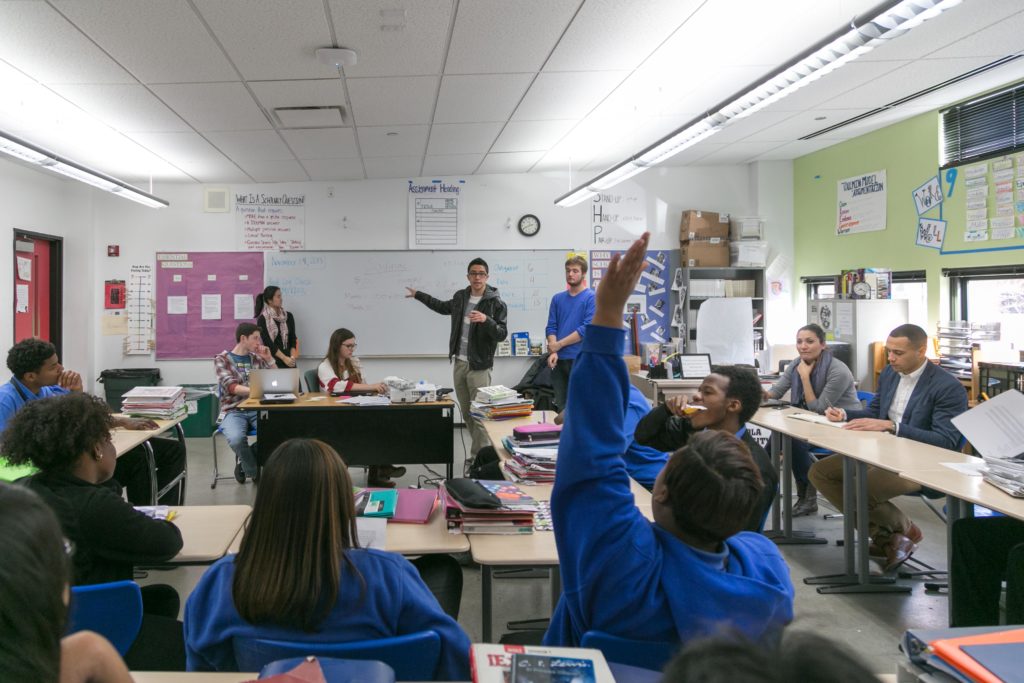

Moneythink was born out of the 2008 economic crisis as a grassroots movement led by a group of University of Chicago undergraduate students. The mission? Inspire younger generations to make informed immediate and long term financial decisions and build financial wellness habits through empathy, mentorship, education, coaching, and practical and emotional support.

Evolution

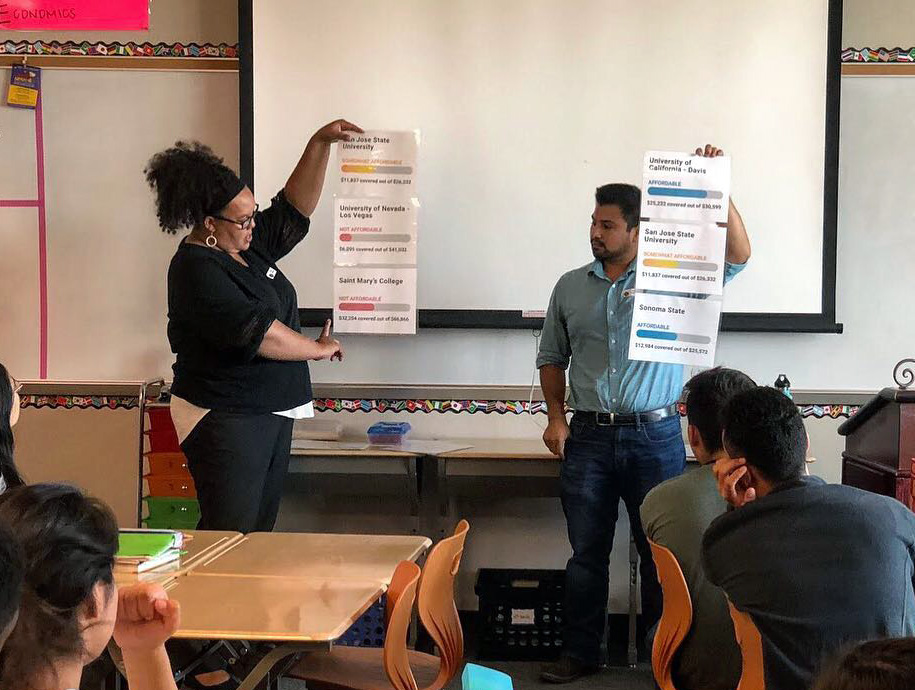

Moneythink remains centered on youth-focused financial wellness. Our nimble, proactive approach enables us to meet and adapt to students’ evolving needs while also tackling the ever-shifting college ecosystem and financial aid changes at hand. With expertise built on years of experience collaborating with students, college advisors and high schools, Moneythink takes inventory of student outcomes and feedback to guide students on their financial journeys. Moneythink uses technology to expand outreach to new populations by collecting and exposing important data that helps better serve students.

Growth

Since our inception, Moneythink has served over 33,000 students across the country. As of 2018, our students accessed over $2.4 million in financial aid. With years-long generous philanthropic support and strategic partnerships, our organization is now a flourishing 501c3 nonprofit with our national team based in the San Francisco Bay Area. To grow our impact, Moneythink designed and released DecidED: a free web-based tool that helps students compare the affordability of college offers against other criteria, such as graduation rates.

The Present

After a decade of direct student service and research on the barriers to college access, Moneythink is expanding student outreach and support for students across the US through our free college affordability comparison tool, DecidED, and continues to inspire its grassroots college chapters across the country. By providing clear and factual information, DecidED encourages students to enroll at affordable schools where they have the greatest chance of graduating with the least amount of debt. Students and their advisors can tap into DecidED anytime, anywhere, all for free.