Our Three Iterations

Financial Mentorship

(2008-2016)

Virtual Coaching

(2016-2019)

DecidED

(2020-Present)

We have been tackling the complex problems around college access and student loan debt from our inception. Our strategies have adapted to meet the most critical needs of our students, while expanding our outreach and programs.

2008-2019

Impacts from our financial mentorship and virtual coaching programs

33,000+

Students served since 2008

$2.4M

Financial Aid received since 2018 for students

42% less

Moneythink students borrowed 42% less than their peers

82%

of Moneythink students completed the FAFSA (vs 55% nationally)

87%

of Moneythink students created financial plans

81%

of Moneythink students enrolled in a recommended affordable college

85%

of Moneythink students reported trusting Moneythink’s advice

2020 – Present

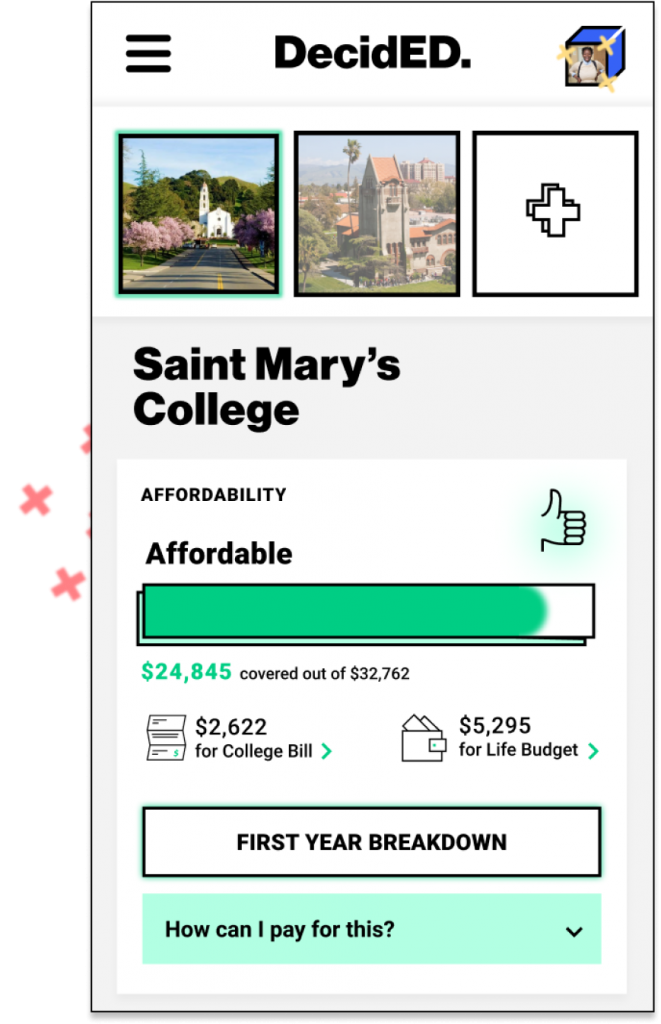

Comparing College Costs with DecidED

The decision of where to go to college is one of the most impactful financial decisions in a student’s life. We developed DecidED to help students make informed and supported decisions about their future.

Our experience coaching students and interviewing hundreds of families, combined with key learnings from the field, led us to the vision for DecidED. We realized the best way to reach and help the most students was to provide them with an easy to use, digital tool that would meet students wherever they were at. We wanted to provide an easy way for students to understand the financial tradeoffs of their award offers against other college fit factors.

DecidED: Moneythink’s free college affordability comparison tool for students, advisors and college access organizations