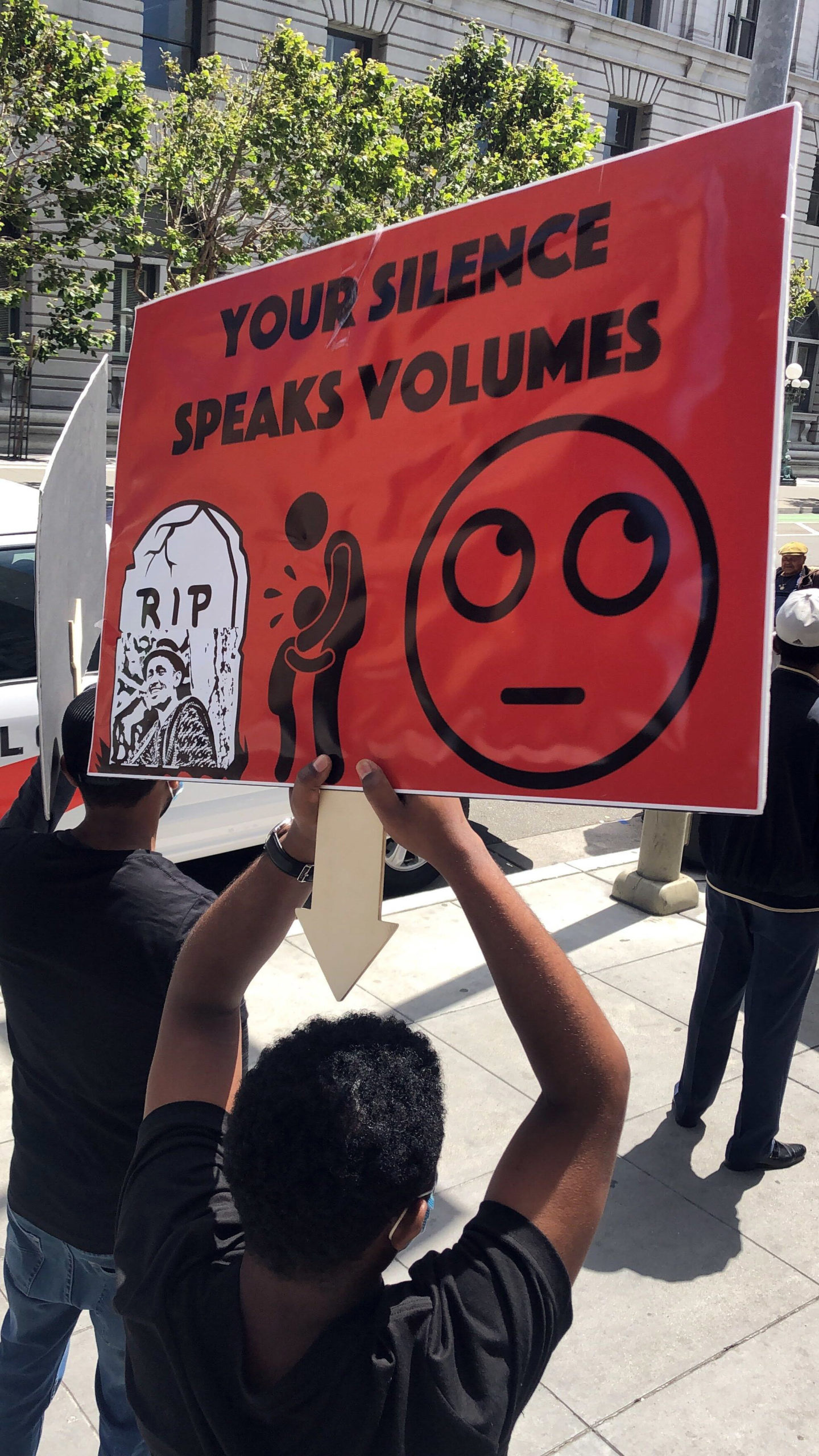

Student Loan Debt is a Social Justice Issue

Moneythink’s mission is built on the promise of a prosperous, inclusive, and equitable society for all. It is time we start talking about student loan debt as a major barrier.

Enrolling in and graduating from college with a financial plan in place is critical for student success in college and beyond. The value of a degree is significant over the course of a lifetime, including being one of the biggest factors in breaking the cycle of generational poverty. For historically marginalized students, however, the probability of attaining a college degree is very low. The issue is most acute among Black and Hispanic students. Just 14% of Black adults and 11% of Hispanic adults hold Bachelor’s degrees, compared with 24% of their white counterparts.

A significant reason for this barrier stems from the lack of transparency in the matriculation process. Full college cost information can be difficult to obtain, hard to compare, and challenging to interpret. Lower income and first-generation students are disproportionately impacted, with too few ways to forecast, prepare, and sustainably afford a four-year degree. Pell Grants only cover up to 30% of the cost of a four-year public college education, so students often take out loans that severely limit their education pathways and economic futures.

Considering the long term consequences of this messy problem affords us a snapshot of the profound impact student debt has on borrowers’ lives and well-being. Consider this: For the 9 million borrowers in default—disproportionately Black students and those from lower-income backgrounds—their inability to pay has dire financial consequences. These consequences include the potential for garnished wages; withholding tax returns and select federal benefits; and impacted credit, which can make it difficult to be approved for housing and certain jobs.

The insidious nature of debt means that entire communities are also impacted – generationally – by this burden: student loan debt also affects families who help students co-sign for loans or finance school. In a recent survey conducted by Moneythink, we asked parents and families what their biggest concerns about college were. Their answer? Over 70% of parents and families polled stated that financing school for their children was a major concern. Additionally, parents and families also stated that lack of transparent college financing information was also a huge hurdle for them. Historically marginalized students are already disproportionately impacted by lack of familial and generational wealth due to systemic barriers imposed onto communities of color. High loan repayments means those communities will be further set behind in attempting to build equity for their families.

These data points, which, mind you, are real people, are simply unacceptable. Together, we must be and do better.

The burden of debt also contributes to acute mental health issues, including prolonged stress, anxiety, and feelings of shame. A 2021 mental health survey indicated 1 in 14 borrowers experienced suicidal ideation in response to the financial stress of student loans. Among borrowers who were unemployed or making less than $50,000 per year, this rate jumped to 1 in 8. 19 million borrowers, or 31% of the total outstanding debt, did not complete their degree — but they’re still on the hook for loan repayments. Nearly 60% of the outstanding student debt is held by Pell recipients.

COVID has exacerbated these consequences, which a recent survey highlights. African American borrowers, in particular, are most likely to feel the long-term stress of student debt while reaping the fewest rewards. While the majority of white students owe less than their original amount borrowed four years after graduation, 48% of Black students owe 13% more than the original loan amount after the same timeframe, and hold 186% more debt than their white counterparts even 15 years after graduation. Whether it’s the high cost of attending school, confusion about continuing financial aid and eligibility, or personal time constraints, college success is increasingly precarious.

These data points, which, mind you, are real people, are simply unacceptable. Together, we must be and do better.

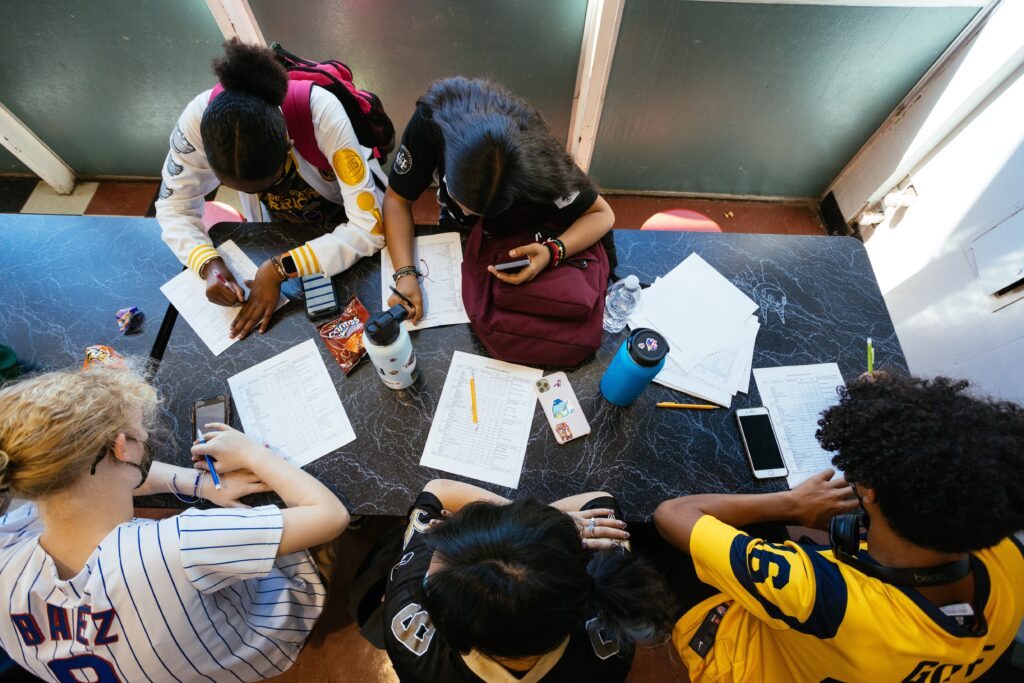

Moneythink has been tackling the complex, interrelated problem of college access and success, affordability, and student debt from our inception. Our approach ensures students who have historically been most burdened by the stress of education debt are prepared to avoid potential financial shocks and stressors that otherwise derail their college and career paths.

From our inception as a grassroots movement across college campuses to our current iteration – bringing our free college cost comparison tool, DecidED, to students and college advisors across the country — we are squarely focused on creating economic equity for all. And as impactful as our solutions are, this effort requires all of us to tackle this big, messy challenge at the scale and urgency at which it exists.

Together, we must do the necessary work to understand the systems and inequities that have created this untenable situation in the first place. As our team and outreach grows, so do our social justice-based actions. We must hold ourselves accountable for creating a new, equitable reality. We take these commitments to heart, which is why our diversity, equity, inclusion and belonging practices are the next steps in helping our team show up for each other and for our students, ask ourselves the tough questions, and demonstrate our implicit values more explicitly in our work.

What are some tangible actions you can take today to help our students? Spread the word about our organization to your friends, families, and networks. If you’re able to, consider donating to Moneythink. Your generous gift enables us to expand the outreach of DecidED. If you’re an advisor or student, sign up for DecidED today. Our tool is free and easy to use.

Together, all of us have the ability to unlock life-changing resources — and real hope — for current and future generations of students. Now more than ever, this is our chance to collectively come together and shift the paradigm.