Our History: How We Use Education-Technology to Inspire Change

In the midst of the 2008 economic collapse, a group of University of Chicago undergraduates saw the opportunity to improve the economic state of their community by providing basic personal finance lessons to students from surrounding Chicago high schools. The undergrads started a club to recruit, train, and place college mentors in local high schools to teach about saving, budgeting, and the importance of financial planning for college and beyond. As students reported back incredible stories about how their newfound understanding of money was helping them in their first jobs and freshman year of college, college volunteers at other universities began using the model to found identical clubs on their campuses. By the fall of 2011, Moneythink had grown organically from a University of Chicago student organization into a 501(c)3 nonprofit volunteer movement on two dozen campuses across the country with a focus on using education-technology to help students make informed financial decisions, especially around college enrollment.

In 2012, Moneythink was awarded the White House Champions of Change award from then President Barack Obama, and raised initial seed funding from the Blackstone Foundation, Ariel Investments, the Lefkofsky Foundation, the Hughes Foundation, Nielsen, and others, to form a central headquarters that could provide strategic direction for the grassroots movement.

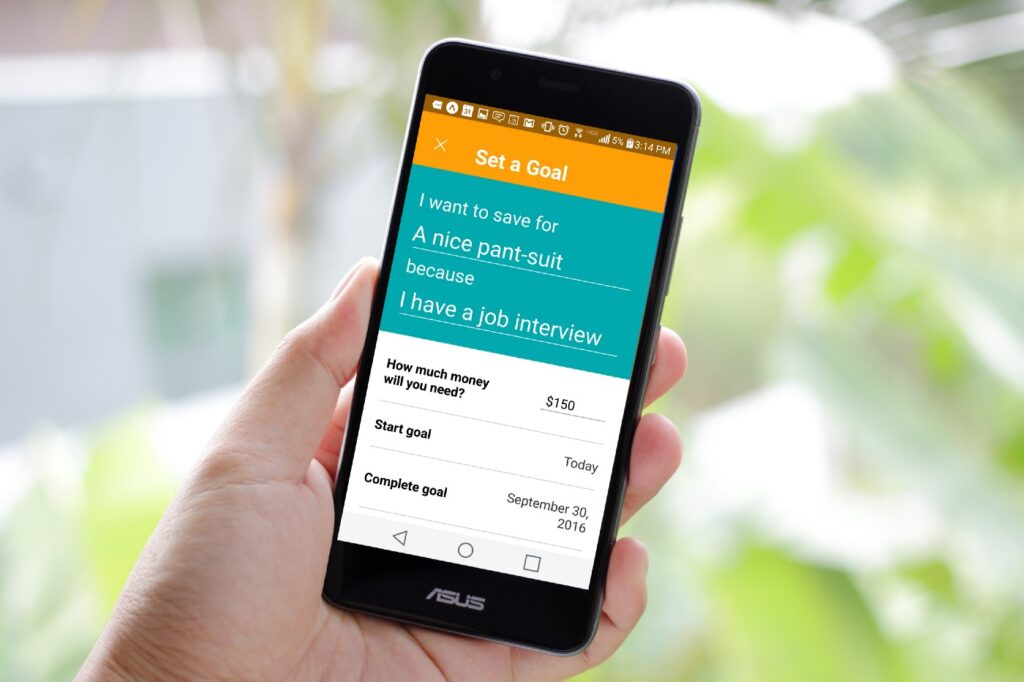

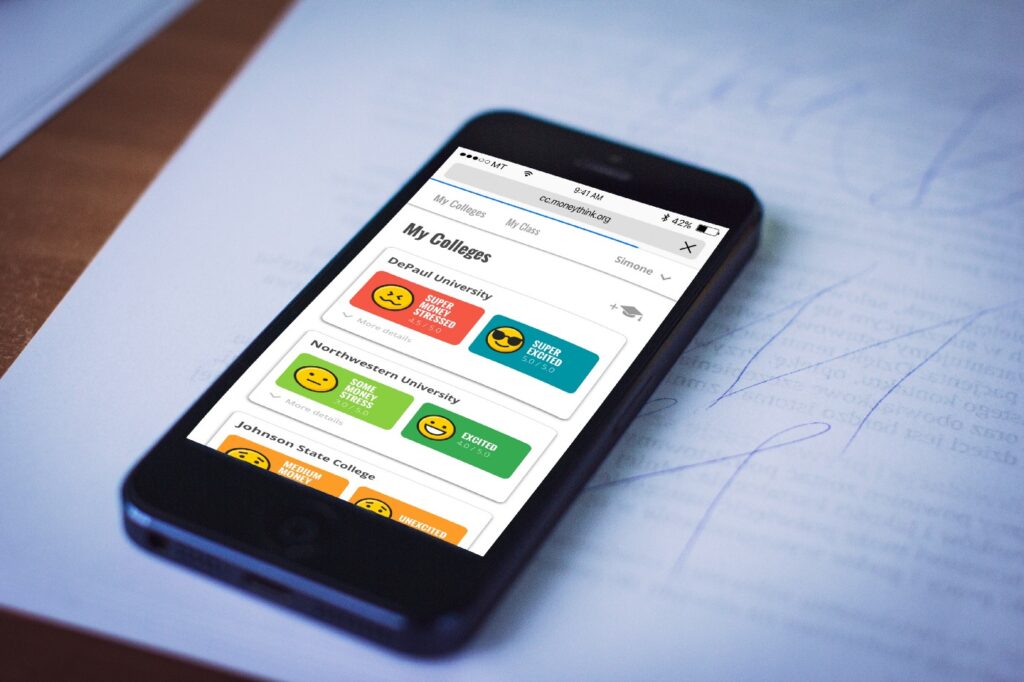

Since then, Moneythink has become a leading organization in the financial capability field. In 2013, collaborations with the Center for Financial Services Innovation (CFSI) and IDEO.org brought financial education out of the classroom and into the real world via our mobile application, MoneythinkMobile. This pioneering education technology application used social media to flip the typical financial behaviors of teens by “instantly gratifying delayed gratification decisions” through likes and comments.

MoneythinkMobile was the first of several education technology iterative experiments on our relentless ambition to discover and prove effective and meaningful applications of financial education. Blended learning technologies, behavioral science, and human-centered design have fueled Moneythink’s innovation engine and helped us achieve meaningful results repeatedly in the classroom, workforce, and college matriculation settings.

The power of human-centered design — a concept we absorbed from our friends at IDEO.org — is that you learn to listen to your beneficiaries and design your solution for what they need.

As we listened to our students from 2012 to 2016, we realized that the transition to postsecondary life — specifically getting a job and affording college — was the greatest area of stress and concern for students.

Thus, in 2016, we launched a research study to educate ourselves on the financial obstacles that first-generation, under-resourced college students face. We interviewed 93 students at 7 different university campuses across the US. They showed us the strong influence financial (in)security has on a student’s likelihood to successfully persist through college and the clear need for under-resourced youth to receive support and guidance when facing important fiscal decisions. Since then we have sought out to design a program that specifically addresses the financial stresses that surface during this influential period in a student’s financial capability development.

Moneythink’s College Financial Success program uses the most effective aspects of our programming — high-touch mentorship, technology, and curriculum — and brings it directly to the student’s fingertips. Our Moneythink Coaches utilize a web-based text-messaging platform to assist under-resourced, college-bound young adults navigate the financial decisions that occur between the beginning of their senior year of high school and the end of their freshman year of college.

We’re able to be there for students whenever and wherever they need us most: outside of the classroom at the exact moments when they’re making some of their most important life decisions.

Since launching our College Financial Success program in the fall of 2016, we have reached 1,080 students in Chicago, Los Angeles, and the Bay Area, and our coaches have sent and received over 51,000 text messages. Our students come to us with questions that range from something as simple as “how do I get to campus?” to as complicated as “how do I know if I’ve been chosen for FAFSA verification?”

More often than not, a student’s Moneythink coach is the only person they have available to discuss their college and financial issues, thus it is imperative that we are so easily accessible whenever these questions arise.

With an unprecedented model, Moneythink is able to meet students where they are to provide the most effective resources and guidance with the highest potential for impact. When students are navigating the FAFSA process, choosing between scholarship opportunities, or even just organizing required health forms to send to the school, a student’s coach is available right at their fingertips to answer questions and demystify the college process.

We walk alongside students in high school, leading up to college, and throughout their freshman year, helping to connect them to the best support and local resources available to keep them on the path to graduation.

And the journey is just beginning.

Be a part of the solution by making a donation, referring a partner, or becoming a corporate contributor.