Supporting Students Through COVID-19 Towards College and Career

Things are changing in real time as colleges decide whether they will serve students on campus or virtually this coming fall. Likewise, students are considering a range of issues such as how far from home they can realistically go, if they need to work sooner than later, and if college expenses are even wise right now. As allies and college financial advisors, our intention is to ensure that all students have the tools and resources they need to make informed and affordable college decisions - ultimately helping them reach their college and career goals. As such, it’s important we know the circumstances students face if we are to strike the balance between giving expert guidance and affirmation as they make this important decision in their young lives.

According to the 2020 Indicators of Higher Education Equity in the United States report, for every 100 low-income and first-generation dependent students entering college, only 26 will have earned a bachelor’s degree six years later compared with 69 of students who are not low-income and first-generation. While more low-income students are attending college, fewer students are graduating on time.

Enrolling in a college with sustainable financial planning is critical for student success — both in college and beyond. Deciding what college to attend, however, is rife with financial risk. Colleges may offer a student dramatically different financial packages, but full cost information can be difficult to obtain, hard to compare, and challenging to interpret.

Why is financial aid so difficult?

In our Financial Need and Ownership Report, we reveal two driving factors of students’ financial vulnerability based on our interviews:

- Unmet Need – the amount that is left to be paid after financial aid is awarded (not including loans).

- A Sense of Ownership – students who view themselves as responsible for their financial situation have an internal sense of ownership over their financial situation.

Unmet need is rarely clear. Award letters are difficult for students, families, and academic counselors to interpret. Because of this:

- The nation’s $1.6 trillion in student debt is fueled by opaque pricing in higher education.

- Only 1-5% of 4-year colleges are considered affordable for first-generation and low-income freshmen, each year.

- 70% of college dropouts leave school due to pressing financial concerns.

- Pell grant recipients, most of whom have family incomes under $40,000, are 5x more likely to end up in default as their higher income peers.

- First-generation students are more likely to end up in default than students whose parents had attended college.

- African-American students are more likely to default on their loans than students of other races and ethnicities.

- And, while 60% of white students borrow money, 87% of minorities borrow to attend college.

This issue is not a partisan one. According to Senator Lamar Alexander on NPR, “We consistently hear from students, parents, and administrators that students looking for federal financial aid to go to college need a much simpler system for the $30 billion in grants, roughly $100 billion in new loans, and the repayment plans for those loans.”

Unfortunately, it’s widely acknowledged that award letters are a major source of the inequity, confusion, and misinterpretation. Here are the Seven Financial Aid Award Letter “Don’t’s” that we’ve identified since 2008:

- Include confusing jargon and terminology.

- Omit the complete cost of attendance.

- Fail to differentiate types of aid.

- Mislead packaging of parent plus loans.

- Provide vague definitions of work study.

- Show inconsistent bottom line calculations.

- Do not provide clear next steps.

In the article The Financial Aid Conundrum, we see that this issue affects all students, but disproportionately for low-income students of color who tend to have a lower sense of ownership. When students lack basic financial literacy skills, they make decisions that are based more on the influences of others than their own needs, and more fueled by opinions rather than critical information.

Moneythink is on the case

Since our inception in 2008, Moneythink has been a leader in financial capability for traditionally under-served youth. From 2008-2016, we mentored 30,000 HS students nationwide using our proprietary financial capability curricula — garnering accolades along the way, such as the White House Champions of Change Award.

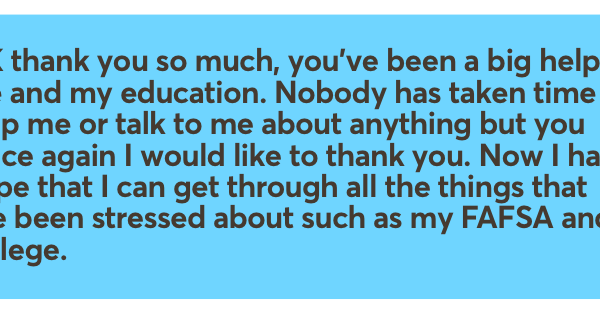

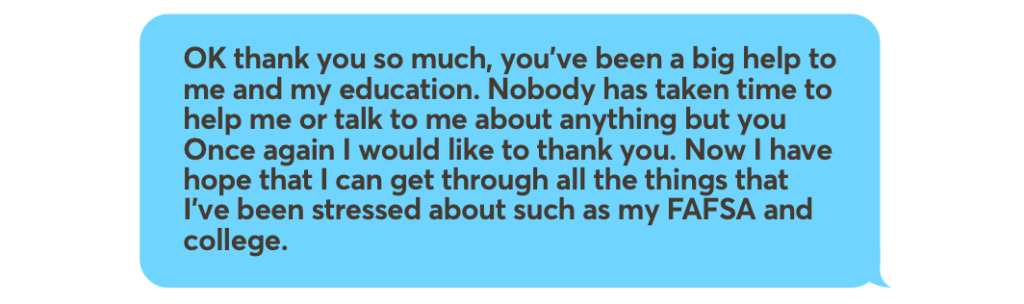

Beginning in 2016, after years of work in financial literacy mentorship, we honed in on one of the most decisive moments in a young person’s life: enrolling and graduating from college with minimal financial burden. With an acute understanding of the obstacles, it was clear that a successful Moneythink program could support the development of youth-focused financial empowerment habits through virtual college financial advising, while also impacting long-term behavioral change and economic status. Between 2017-2019, we provided financial college coaching to over 2,500 students in Illinois and California.

Along the way, it became clear that we could support the field as content experts focused on providing objective financial aid coaching. We convene advisors and organizations already doing great work and optimize their financial aid coaching with our tools, content, and training.

In my interview with Next Gen Personal Finance Co-Founder Tim Ranzetta of the “Tim Talks To…” Podcast, I remind the field:

“It’s not because there isn’t a standard format. The Department of Education has suggested a financial aid award template to help clarify and systematize the information across different colleges. But it’s really up to colleges to decide how to format the information, the language they use. And we’re really seeing a lot of variance between college financial aid award letters.”

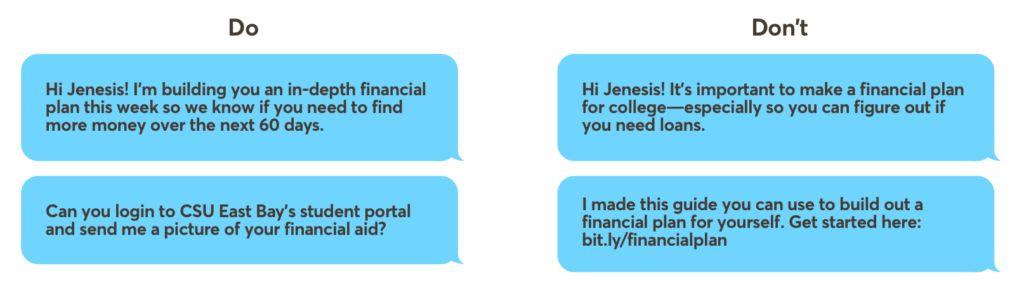

We know that students, families, and educators need to have tools at their fingertips to make sense of the information they can get, in whatever format it’s in, to make a truly informed choice that keeps student goals at the center.

This is where Moneythink’s new affordability tool, DecidED, comes in.

What Moneythink’s DecidED can do for YOU and Your Students

Our tool, DecidED, completely removes the guesswork out of college affordability for students and their families, as well as empowers counselors and advisors in the space. Moneythink’s tool, DecidED, scheduled for full release in the fall, 2020: .

- Helps students make a holistic college enrollment decision informed by an accurate understanding of the cost of their college options.

- Provides focused, action-oriented, personalized content that helps students, families, and advisors make well informed enrollment decisions based on clear guidelines and methodology.

- Helps schools, districts, and college access organizations extend the reach and impact of services by scaling financial aid literacy and action-enabling tools with technology and reporting.

DecidED can support educators and institutions during, throughout, and after the financial aid application process for students.

- Educators and Institutions will be able to use DecidED for relevant, accurate financial aid guidance, advising, and tools so that they can navigate the “next normal” as education systems re-invent themselves.

- Administrators and Advocates can use DecidED for training, research, stories, and data that can inform reform as educators reconsider education priorities in light of lessons learned this year. We also share relevant, timely information and resources such as the NACAC Enrollment Deposit Fee Waiver and SwiftStudent for appeals.

DecidED helps students complete financial aid transactional steps and make a holistic college enrollment decision.

- Students use DecidED during the financial aid application process to:

- Receive FAFSA/CA Dream Act submission reminders and instructions;

- Make highly informed enrollment decisions grounded in an accurate and complete understanding of college costs;

- Compare true apples-to-apples affordability levels, quality, and fit across multiple college options;

- Consider how graduation rate and future salaries outcomes might influence their enrollment decision;

- Have productive conversations about the tradeoffs of college options with advisors and family; and

- Create a data-driven financial plan to responsibly pay for their college years.

- Students use DecidED once in college to:

- Receive FAFSA/CA Dream Act renewal reminders and instructions for 2nd+ year of college; and

- Continue to make highly informed decisions related to their financial plan to responsibly pay for their remaining college years.

Using our cutting edge-technology, DecidED clarifies the difference between gift aid (what students don’t have to pay back such as grants and scholarships) and self-help (what students have to pay back or earn such as loans and work study), and makes clear what the costs of attendance are. Only with all of these pieces can students and families fully understand 1) what college will cost, 2) how much outside aid they will get to go there, and 3) what is left for the family to cover. By helping students make affordability-informed enrollment decisions, we expect that will increase the chance of students obtaining a bachelor’s degree, within their expected time to completion, with a sustainable amount of debt.

Partner with Moneythink to scale success

Whether you are a high school counselor, a school administrator, a district director, an education advocate, or a college access program lead, we want to help you scale your success.

Here are the different ways you can engage with Moneythink to enhance your services and extend your impact.

- Sign up for a DecidED Demo this summer and learn how the tool can be used by you and your partners.

- Sign up for a Moneythink Partnership Info Session this summer and find out how partnership with Moneythink can improve your student outcomes and increase your team’s capacity to advise and affirm.

- Sign up for a Moneythink Financial Aid Training for the fall and let our content experts update your staff on financial aid policy, financial aid applications, and best practices in the field.

- Sign up for the DecidED Pilot for the fall so that we can offer your organization the collaboration, data, tools, and resources to help your students succeed.

- Sign up for a Moneythink API Info Session if you’d like to learn more about how our data, reporting, and API resources can compliment and improve your existing tools and reports.

DecidED comes at a critical time when K-12 systems are still waiting to understand how the coronavirus will impact school plans for the 2020-2021 Academic Year. Moneythink can support education leaders in designing a new normal for graduating high school seniors, incoming college freshmen and incoming college transfers that learns from old lessons and prevents more students from making ill-informed and unaffordable college decisions.

Together, we can help our students not just survive, but thrive. Not just complete, but succeed. Our students can achieve #lessdebtmoredegrees, and at the same time, design a pathway towards an economically sustainable future for themselves, and their families.

About the authors:

Joshua Lachs serves as the CEO at Moneythink, a national ed-tech nonprofit that aims to bring college cost transparency to scale while helping all students have the opportunity to earn a college degree with little to no debt.

Meredith Curry is a Senior Advisor at Moneythink. Meredith has served as the Founding Director of Operations at California College Guidance Initiative and the Executive Director at South Central Scholars.

As former first-gen college students, Josh and Meredith each know firsthand that the financial side of college can be daunting and are both inspired to ensure that students have access to the opportunities they deserve.