Student Success Series: Gabby Davis

Gabby joined Moneythink in January 2017 as a high school senior from Perspectives Leadership Academy in Chicago. She was part of the first cohort of students in Moneythink’s College Financial Coaching program. In early September, Gabby sat down with Moneythink staff to discuss her experiences with her Moneythink coach over the last few months. Her warm personality and diligent attitude were immediately apparent and amplified when you meet her in person.

The Beginning of Gabby’s Student Success Story

Ever since Gabby was little, she knew she wanted to attend college.

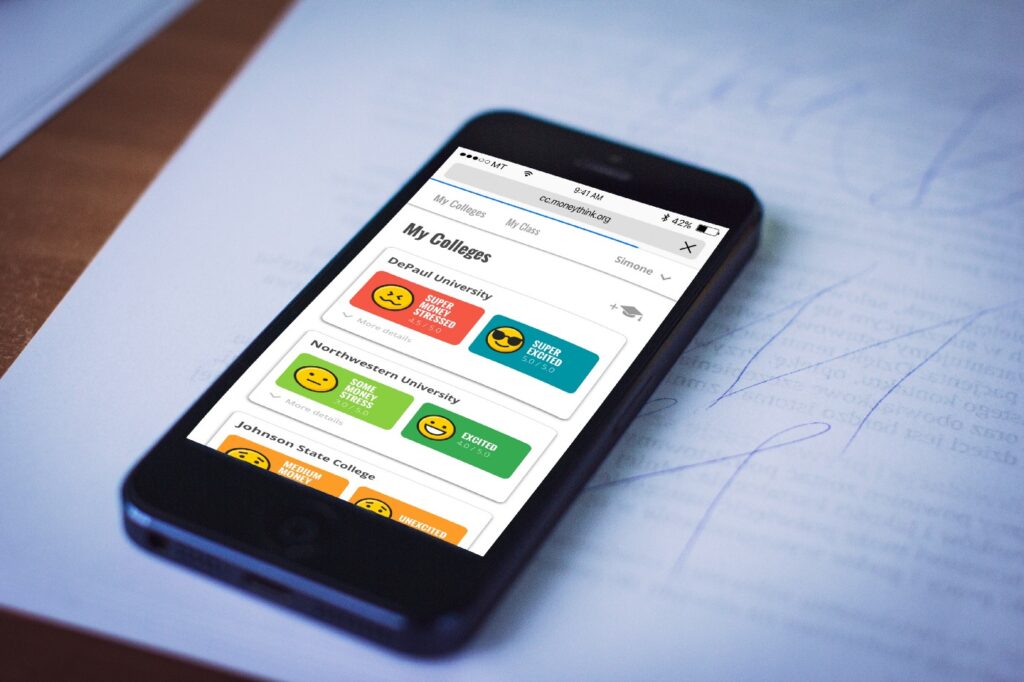

“I was always telling my mom, ‘I wanna be a dentist, I wanna be a dentist!’” Both her parents were college graduates. Gabby knew college would not only help her get a good job, but also was a way to “do good for [herself] and her future.” However, she also knew that paying for college was going to be a large obstacle. “It was hard finding a good college because you need money to go out of state, and I didn’t have scholarships at the time, so I knew I was going to go to a community college first no matter what.”

Gabby began looking at community colleges in Chicago and was drawn to a college because of its dentistry program. With help from her school counselors and mother, Gabby applied and was accepted. However, it was her Moneythink coach that kept her on track throughout the summer, a time when many students run into problems that can derail their college plans.

Up to 40% of students who intend to go to college never show up on the first day. The causes are often small and avoidable.

Over the summer before college, students are asked to complete a number of complicated tasks. This is a time when they have very little access to support from a high school counselor. Researchers call this phenomena “summer melt.” Unfortunately, the complications Gabby ran into are incredibly typical.

Running into Complications

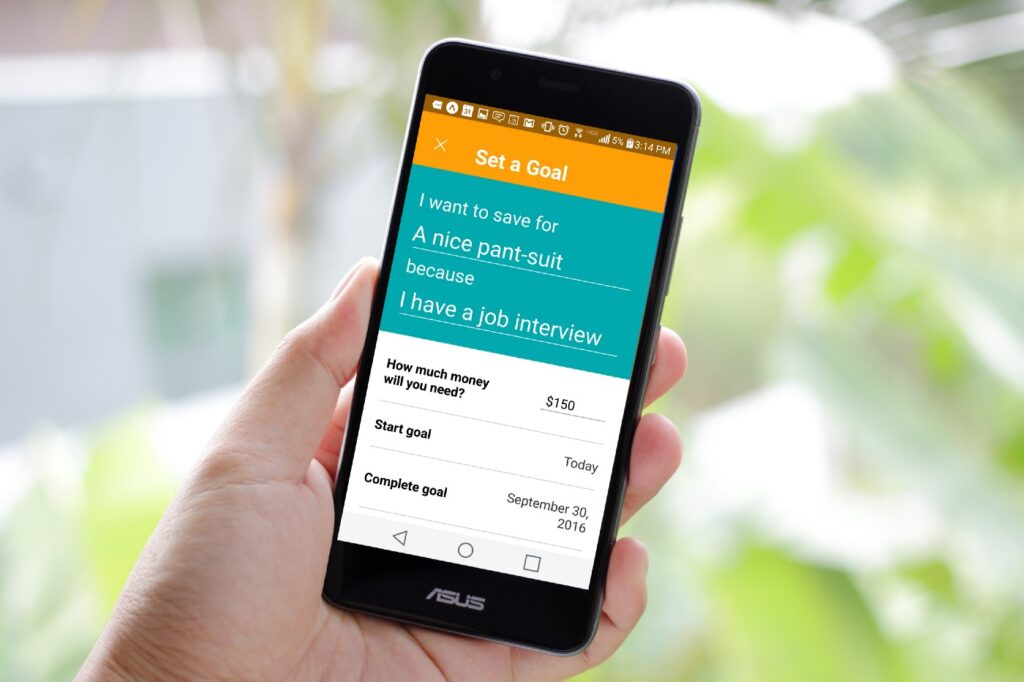

Gabby is a recipient of the Star Scholarship, a scholarship offered to high-achieving Chicago Public School graduates that allows them to pursue an Associate’s Degree completely free of cost. However, Gabby had trouble receiving her scholarship on time. She worked with her Moneythink coach, Miesha, to figure out what was wrong. Miesha helped guide her through each of the steps she needed to take to get the issue resolved.

“Miesha was telling me where to go and… basically guiding me to ask my advisor questions I never thought to ask. She gave me things to think about that I needed to know in order to be successful.”

Gabby Davis

Orientation dates were passing by and classes were beginning to fill up quickly; but without her scholarship, Gabby was unable to complete any of her summer tasks.

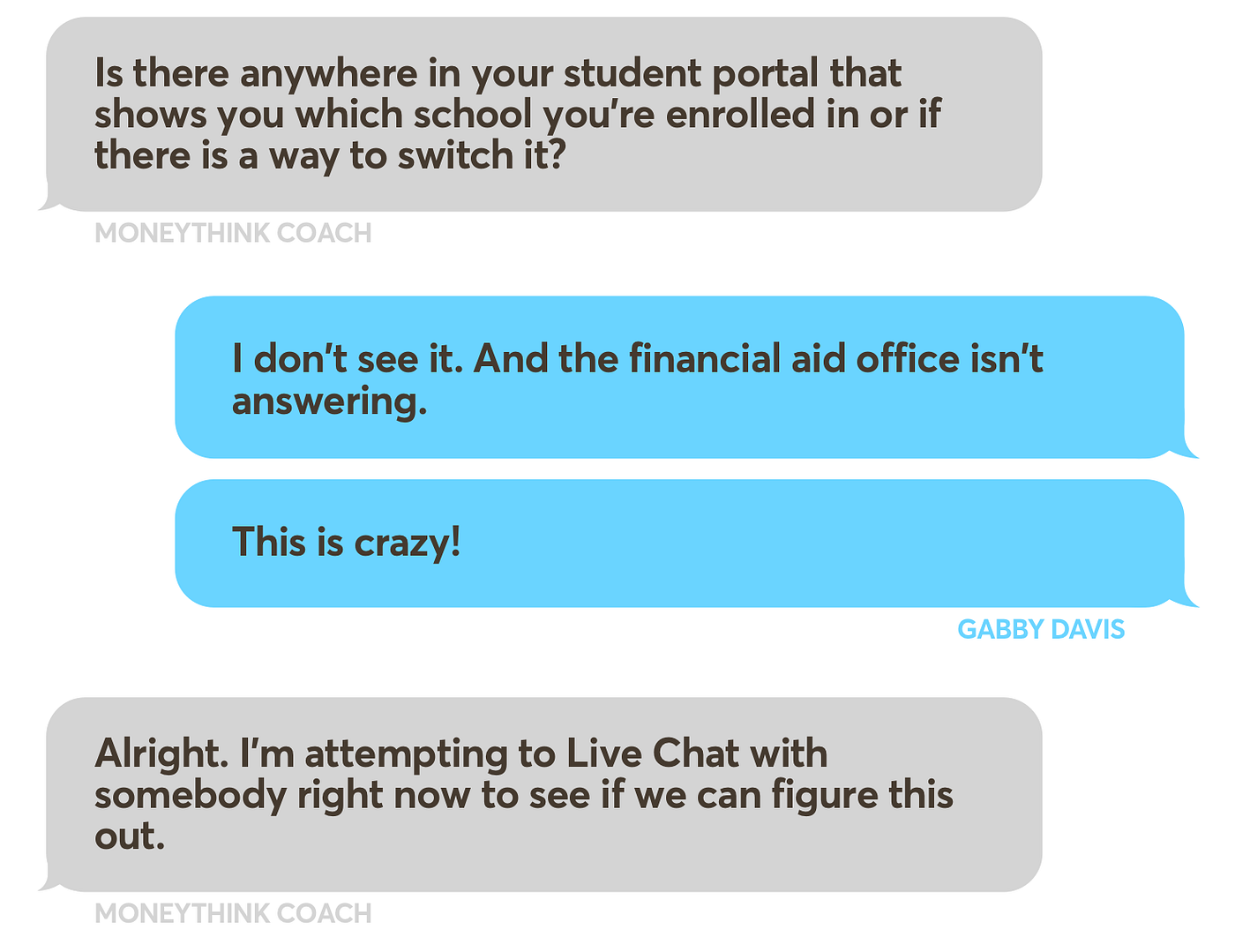

After checking to make sure her FAFSA documents were accurate, Miesha encouraged Gabby to call the college’s financial aid office. It took five attempts to get somebody to answer the phone. Even then, the financial aid officer couldn’t provide an answer to why her scholarship was not going through.

Determined to figure out the issue, Gabby went down to the campus’ financial aid office herself. She learned that because she had taken a class at a different city college in the spring, the system still had her enrolled there. This meant she couldn’t receive her scholarship or even enroll in her classes until the issue was fixed. Because of Gabby’s Moneythink coach pushing her toward student success, Gabby was able to fix the situation.

Gabby was proactive in arranging a meeting. As a result, the school was able to correct the mistake within the week, process her scholarship, and register her for orientation.

One small glitch in the college’s system required multiple phone calls, emails, and an in-person visit to resolve — this is the kind of seemingly small detail that could result in a student never making it to the first day of college.

By nudging Gabby to stay on top of her summer tasks, her Moneythink coach was able to not only help her navigate the complicated process of receiving her financial aid, but guide her on the path to student success. Moneythink’s coaching program also gave Gabby the confidence to be proactive about finding the right campus resources that could provide support.

“We don’t know each other personally, so for [Miesha] to tell me ‘you can do it’ and believing in me… it just really gave me a feeling like ‘they believe in me, so I should believe in myself and that I know I can do it and I can get far.”

Gabby Davis

After receiving her Associate’s Degree in Dentistry, Gabby plans to transfer to University of Illinois at Chicago to pursue her Bachelor’s, and is continuing to work with her Moneythink coach to ensure she stays on track.

Be a part of the solution by making a donation, referring a partner, or becoming a corporate contributor.