Reducing Income and Wealth Inequality: How Moneythink Supports All Students

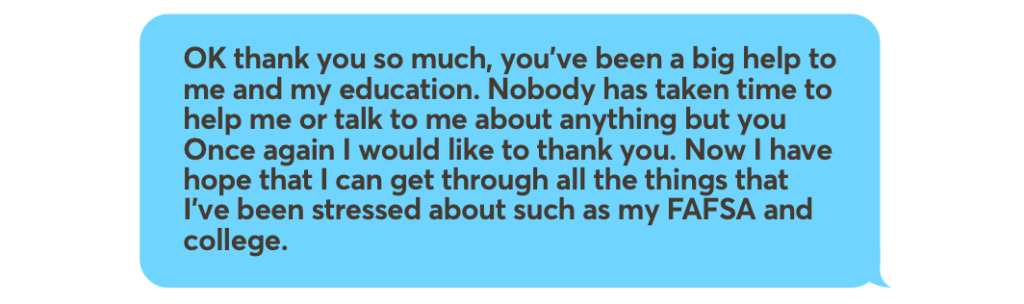

The road to a college degree is precarious for many, especially for students who do not have access to support systems or guidance throughout the application process. Moneythink addresses and solves these gaps. Our organization was founded by and for students through student-driven grassroots movements. That’s why we are uniquely poised to empower students on their college journey. We have firsthand knowledge and experience thanks to the incredible students who founded our organization, and we continue to center diverse and ever-changing student needs in everything we do.

Challenges Students Face

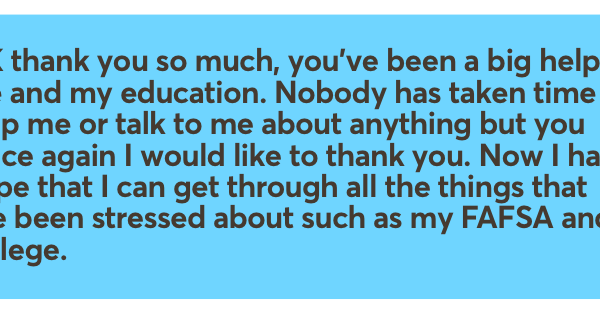

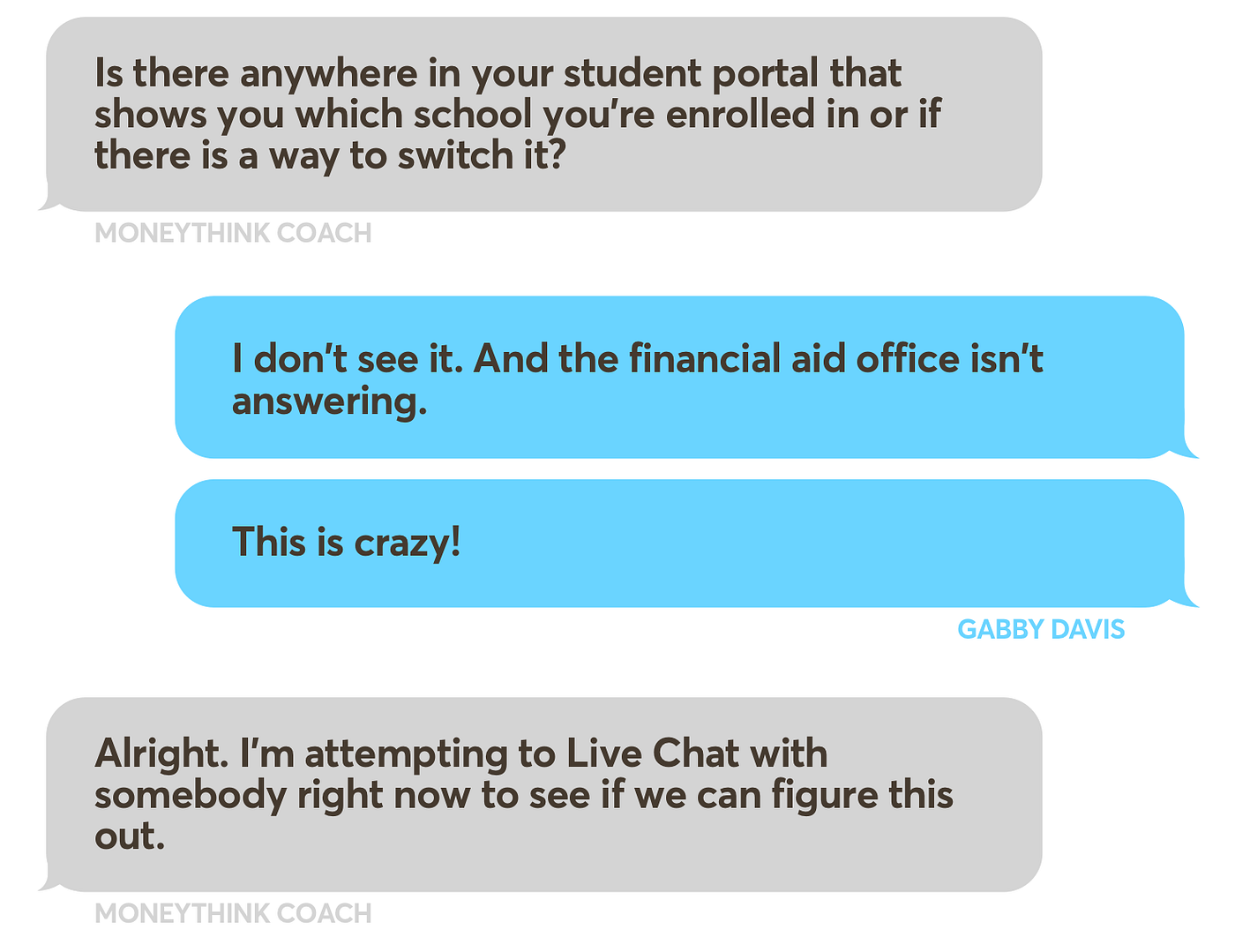

Our students come from unique backgrounds. They are aspiring, imaginative, gifted, creative, and powerful, but many are denied access to necessary systems, support and crucial information during the college process. Roadblocks include confusion around financial aid, lack of personal support, a confusing application process, and more.

These roadblocks lead directly to missed opportunities, increased student loan debt, and put students in cycles where they cannot thrive or obtain true economic mobility. Our organization’s mission is to remove as many barriers as possible in the way of students’ success at this stage of their life journey. We directly address the gaps that students may fall through, and tackle head on the interrelated and complex issues of college affordability, student success, and loan debt.

How Does Wealth Inequality Impact Students?

We can’t talk about social justice without naming the wealth inequality many of our students face. For students who already lack resources, cycles of income inequality affect them disproportionately compared to students with simultaneous access to resources and access to wealth. Often, access to wealth correlates with access to important resources and support systems.

Take this startling statistic: a lower-income but high-performing student has less of a chance of graduating college than a high-income lower-performing student. Much of this disparity exists because wealthier students have access to resources and support than lower-income students do. For instance, wealthier students are often placed in better resourced school districts, complete with financial literacy coaching, college counselors, standardized testing preparation, and family support.

The chasms of wealth are becoming more prominent in our country and it’s clear that the obstacles many students face are not individually created, but systematically imposed. As our organization grows, we are adapting our work to reflect and address this reality.

How Our Work Has Evolved With Students at the Center

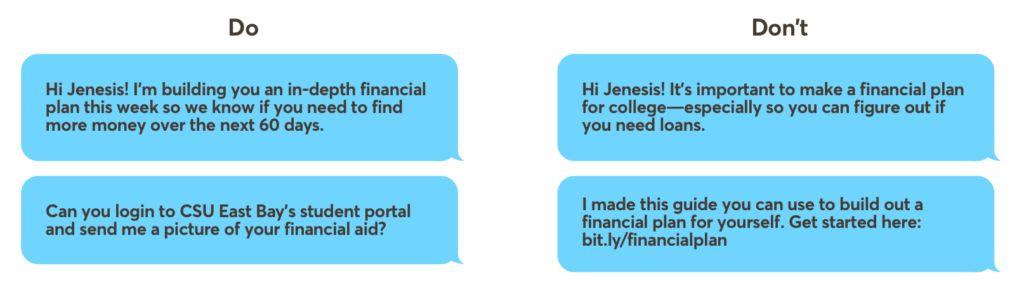

From our inception, we’ve kept students at the forefront of everything we do. Throughout all of our iterations – from our financial mentorship programs to virtual coaching to the creation of our free, college cost comparison tool, DecidED in 2020 – we have pivoted to meet student needs.

While our initial mentorship and virtual coaching programs focused a lot on teaching students how to manage college related finances, we’ve realized that the issues many students face go far beyond what any individual alone can fix. DecidED is such an important leap in our work because our tool allows us to reach more students across the country, anytime, anywhere, while providing support, and the free, crucial and transparent information they need to attend college with the least amount of debt. DecidED is a game changer because the information our tool provides helps students make resourced and informed decisions.

When students use DecidED, they upload financial aid award letters, and compare colleges based on both financial information and other important fit factors, like majors, graduation rates, and more. Advisors can also use DecidED to keep in touch with students and provide further support. However, we designed DecidED so that students could navigate the college application process on their own, especially if they come from under-resourced situations.

If students are able to make a fully informed decisions, they are able to reduce the amount of debt they take on to finance school, and are able to utilize their degree in ways that help build wealth and stability.

Students Benefit From Our Work

Addressing college affordability remains at the heart of our work because we understand the crucial importance of obtaining a college degree. A degree can help lift students and their communities out of poverty, particularly if graduates do not need to worry about exorbitant loan repayments or debt.

One of our recent alums, a student from Pittsburg High School, says of college affordability: “If we are going to be honest, finances play a big role in choosing where you go whether you like it or not. Being able to afford college is what we need.”

Our work has helped over 33,000 students afford college across the country since 2008. These successes speak for themselves. As of 2018, our students have received over $2.4 million in financial aid, with 82% of Moneythink students completing their FAFSA (compared to the 55% national average). Over 80% of our students created a responsible financial plan to pay for college and ended up graduating from one of Moneythink’s recommended affordable schools.

With recent improvements to DecidED, we have pivoted focus on helping students quickly and easily understand college affordability criteria, so they can make fully informed decisions faster than ever before. The affordability rankings within our tool also match recommendations from reputable college access organizations.

Thanks to these usability improvements, students are more engaged with DecidED. Over 98% of student users utilized DecidED beyond the sign up stage, by uploading award letters, adding schools to their list, and comparing colleges. Although many of our student users are based in California, we have also expanded outreach all across the country, with highest engagement coming from students in Massachusetts, New York, Texas, Pennsylvania, Illinois, and Maryland.

And most important of all, over 57% of DecidED users selected an affordable college.

You Can Support Students, Too. Here’s How.

Our work wouldn’t be possible without supporters like you. In order to maximize our impact and outreach, spread the word about Moneythink to your friends, families, networks and communities. If you know a student on their college journey who is in need of financial aid information or support, encourage them to sign up for DecidED. (It’s free!) And if you’re able, consider donating to Moneythink. With your help, our work can reach more and more students, and provide game changing resources to those who need it the most.