Employee Voice Series: Elizabeth’s Success Story

By Elizabeth

As a first-generation college graduate, I feel a deep connection to the work we do at Moneythink. The students we help are smart, hard-working, responsible, and strongly committed to getting a solid education despite their odds. I love that our work helps to address the problem of unequal access to education in our country by providing personal support to students. I believe in using my experiences to help guide students’ success stories.

My Beginning

I grew up in a small town in Oregon with limited educational opportunities. I was raised by an incredibly resourceful single mother who worked and saved to provide for her four children.

With the support of my older brother, I moved to a bigger city where I attended community college while working two part-time jobs. When I see our students managing work and school — as well as family responsibilities — I empathize with the everyday stress they experience and the strain this can have on their academic success stories.

I understand first-hand the challenges that face our students, many of whom don’t have the same financial and social advantages as their well-resourced peers.

Elizabeth

My College Experiences

With support and encouragement from my community college professors, I transferred to Amherst College in Massachusetts in just a few years. I was very lucky that Amherst has numerous resources for first-generation and transfer students.

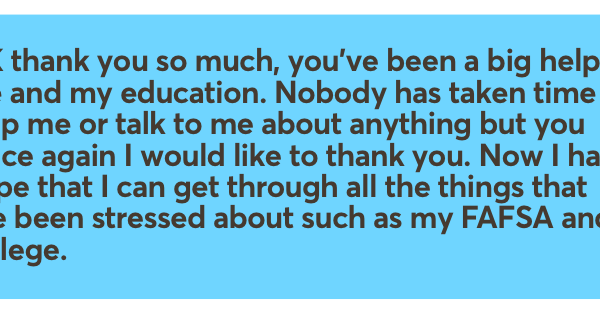

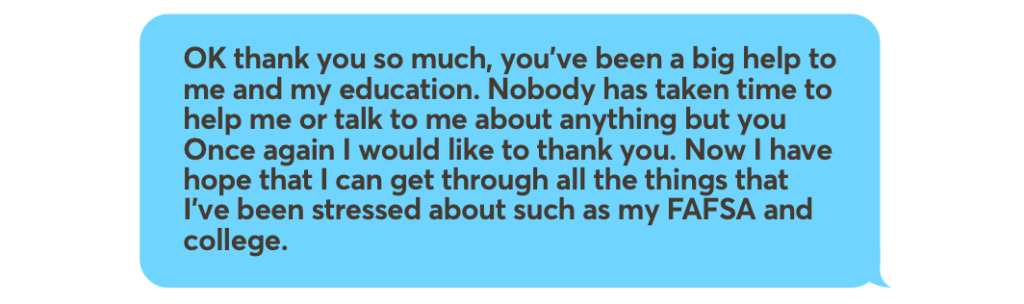

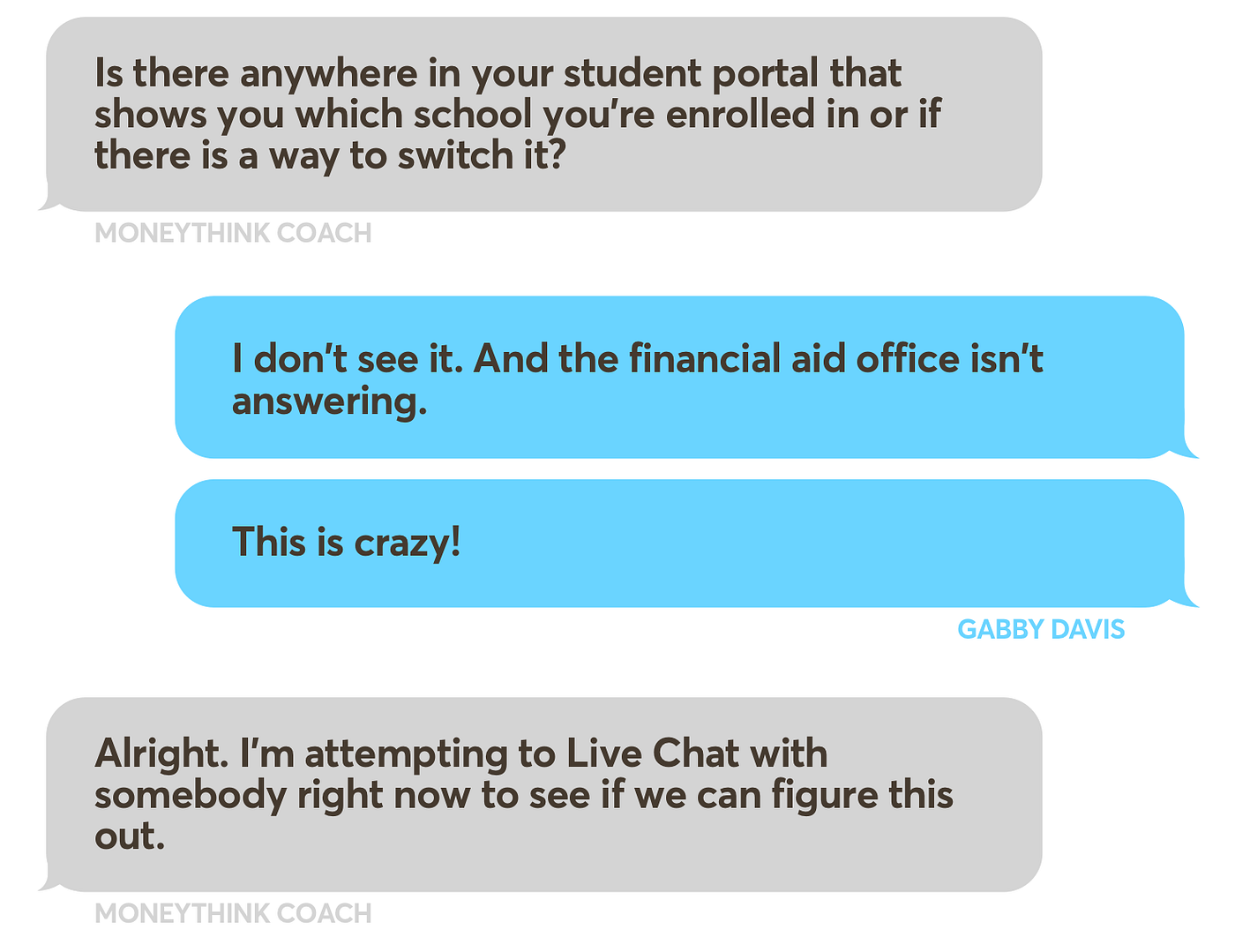

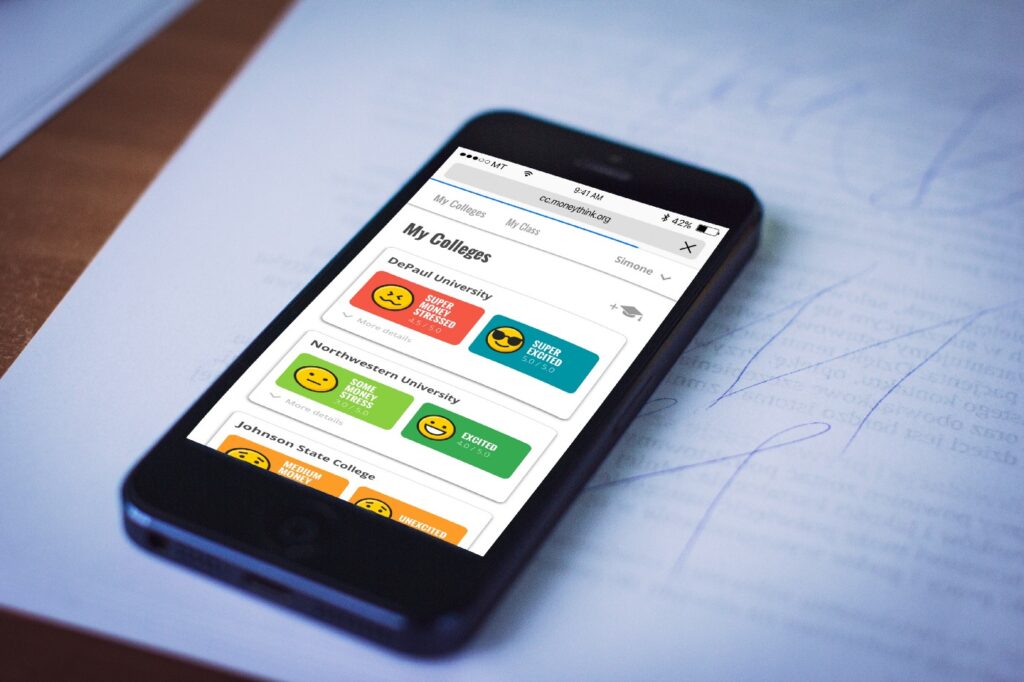

However, I was far from home. It was my job to make financial and academic decisions largely on my own. When I see the confusion my students have about how to talk to their professors or how to make sense of their financial aid awards, I understand all too well. By providing guidance when they experience similar confusion, Moneythink is filling a huge gap in our students’ lives and guiding them on the path to success.

Working with Moneythink

Before becoming a part of this amazing team, I had worked for several years in different areas of education. Throughout my professional life, I’ve always been excited about supporting youth and improving education.

What drew me specifically to Moneythink is the opportunity to work in a small but powerful organization that is focused on well-developed, creative solutions to removing barriers to higher education.

I carry such a strong connection to our mission, and I love our approach. We work with students who already have the will to go to college, but who just need that extra help with designing the way.

As far as I’m concerned, there is no good reason why students should ever drop out of college due to a lack of access to sufficient information or support networks.

Elizabeth

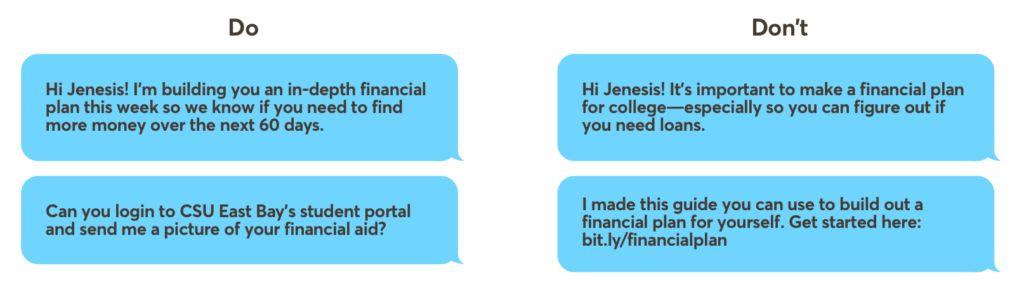

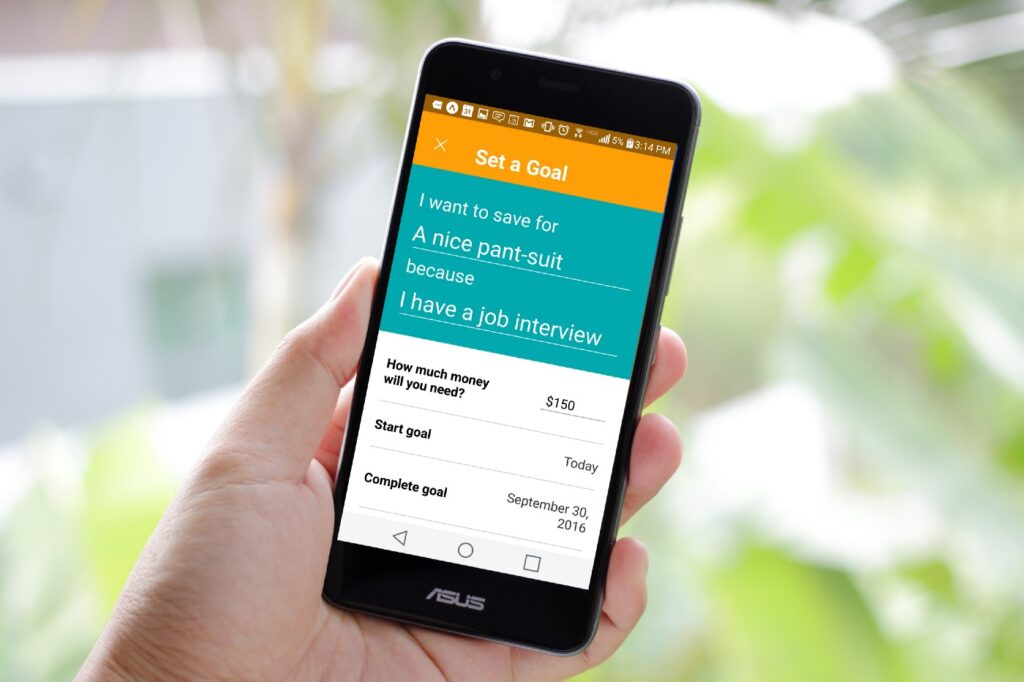

Moneythink is addressing this issue by providing exactly the kind of timely, highly-focused support that students need when navigating their journeys to and through college.

Be a part of the solution by making a donation, referring a partner, or becoming a corporate contributor.